SINGAPORE — A day after Singapore relaxed Covid-19 rules and stood down the Multi-Ministry Taskforce, Finance Minister and Deputy Prime Minister Lawre

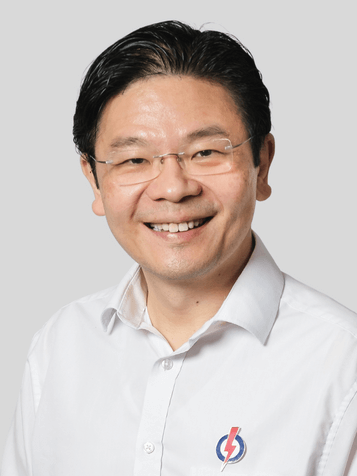

SINGAPORE — A day after Singapore relaxed Covid-19 rules and stood down the Multi-Ministry Taskforce, Finance Minister and Deputy Prime Minister Lawrence Wong delivered the 2023 Budget Statement, titled “Moving Forward in a New Era,” on Feb. 14. This is Wong’s second budget address, and it outlined Singapore’s fiscal position for 2022 and beyond.

Drawing on past reserves

The government drew S$6 billion from past reserves to fund pandemic-related expenditures in 2022. With the situation stabilizing, this year’s draw is expected to be lower, at S$3.1 billion. In total, Singapore will have drawn around S$40 billion from FY2020 to FY2022, less than the originally anticipated S$52 billion.

More financial help

Several fiscal measures were introduced to help Singaporeans manage rising costs and the GST hike. These include enhanced GST vouchers for eligible households, increased cash payouts, and U-Save rebates. Lower-wage workers will also benefit from a S$2.4 billion top-up to the Progressive Wage Credit Scheme.

Support for families and homebuyers

Parents will see increased financial support through a higher Baby Bonus and enhancements to the Child Development Account. Fathers of children born in 2024 will receive four weeks of paternity leave, while first-time homebuyers will receive priority and an increased CPF Housing Grant.

CPF changes for platform workers

Platform companies will be required to contribute to CPF for workers under 30, and the CPF monthly salary ceiling will be gradually raised over the next four years.

Tax adjustments

From Feb. 14, tobacco taxes have increased by 15%, and higher taxes will be levied on luxury cars and higher-value properties. Singapore will also implement a Domestic Top-up Tax, raising the effective tax rate for multinational enterprises to 15%.

COMMENTS