The Assurance Package, aimed at helping households manage the upcoming Goods and Services Tax (GST) increase, has been boosted by an additional S$1.4

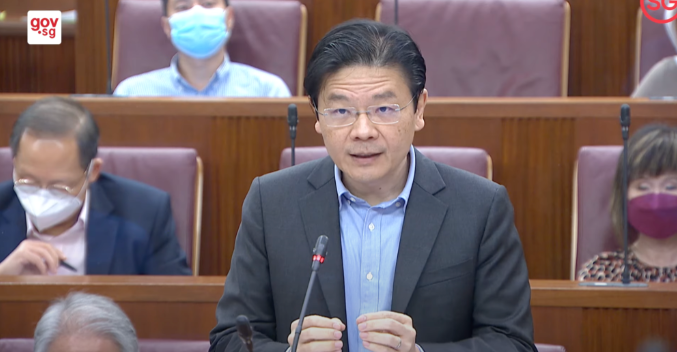

The Assurance Package, aimed at helping households manage the upcoming Goods and Services Tax (GST) increase, has been boosted by an additional S$1.4 billion, bringing the total package to around S$8 billion. This was announced by Deputy Prime Minister and Finance Minister Lawrence Wong during the second reading of the GST Amendment Bill on Nov. 7.

Wong noted that this top-up follows a review of the “elevated” inflation situation. Details of the package’s enhancements will be shared at Budget 2023.

The GST will rise by 1% on Jan. 1, 2023, and again by another 1% on Jan. 2, 2024.

Addressing inflation and protecting households

Wong highlighted that this enhancement is necessary to offset additional GST expenses for the majority of Singaporean households for at least five years and up to 10 years for lower-income households. He pointed out that inflation, along with household expenditure, is expected to remain high in the coming years.

Initially announced in 2020, the Assurance Package was valued at S$6 billion and later enhanced with S$640 million at Budget 2022.

Permanent GST voucher scheme to continue beyond the Assurance Package

While the Assurance Package is temporary, Wong reassured that the permanent GST Voucher Scheme will continue to help households offset GST costs long after the package ends. Through the GST vouchers, lower- to middle-income households can defray a significant portion of their GST expenses permanently.

These vouchers come in four components: cash, Medisave for seniors, U-Save rebates for utility bills, and Service and Conservancy Charges (S&CC) rebates.

Wong also noted that the government absorbs GST for publicly subsidized healthcare and education, ensuring that lower-income households continue to be supported.

Singapore’s multi-tiered GST system

Wong emphasized that Singapore’s multi-tiered GST system ensures fairness, with lower-income households paying a much lower effective GST rate than higher-income households. “On average, the bottom 10% of households do not pay any GST at all after permanent offsets,” he said.

Updates to GST on travel-arranging services

Wong also discussed a key amendment to the GST treatment of travel-arranging services. Beginning Jan. 1, 2023, GST will be applied based on where the person who contracts for and benefits from the service belongs, rather than the location of the accommodation or transportation. This ensures consistency in GST treatment for local and overseas providers.

Strengthening revenue for the future

Wong stressed that the GST increase is a critical revenue move to support growing healthcare expenditures and the needs of Singapore’s aging population. He affirmed the government’s commitment to helping Singaporeans, especially the less well-off, through the transition.

Top image via Gov.sg YouTube.

COMMENTS